Portfolio Rebalancing in Times of Stress

Joint with

A. M. Fischer,

C. Grisse

and S. Kaufmann.

Journal of International Money and Finance, 2021, 113:102360.

Abstract

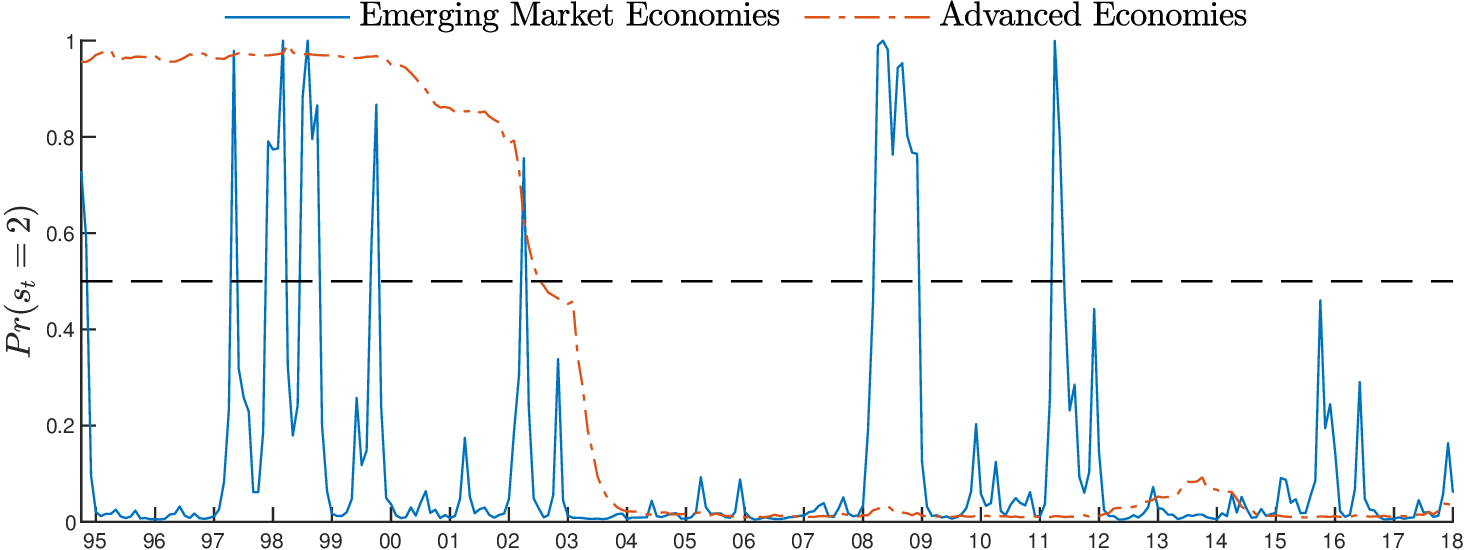

This paper investigates time variation in the dynamics of international portfolio equity flows. We extend the empirical model of Hau and Rey (2004) by embedding a Markov regime-switching model into the structural VAR. The model is estimated using monthly data from 1995 to 2018, on equity returns, exchange rate returns, and equity flows between the United States and advanced and emerging market economies. We find that the data favor a two-state model where coefficients and shock volatilities switch jointly. In the VAR for flows between the United States and emerging market economies, the estimated states match periods of low and high financial stress, both in terms of the timing of regime switching and in terms of their volatility characteristics. Our main result is that for equity flows between the United States and emerging markets rebalancing dynamics differ between episodes of high and low levels of financial stress. A switch from the low- to the high-stress regime is associated with capital outflows from emerging markets. Once in the high-stress regime, the response of capital flows to exchange rates and stock prices is smaller than in normal (low-stress) periods.